Stabenow, Wyden, Senators Call for Review of Trump’s Tax Returns in Light of Ongoing Russia-Trump Associates Investigations

The Senators sent a letter today to Senate Finance Chairman Orrin Hatch urging him to request a copy of President Trump’s personal and business tax returns

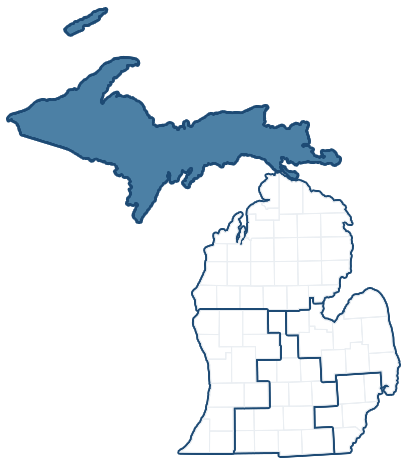

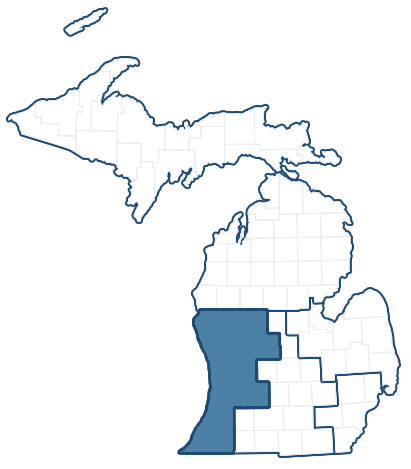

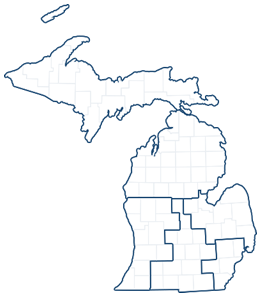

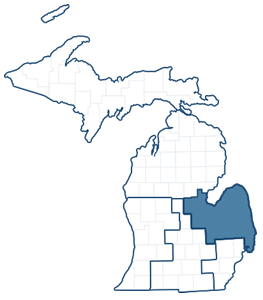

Wednesday, March 01, 2017WASHINGTON, D.C. – U.S. Senator Debbie Stabenow (D-MI), Senate Finance Committee Ranking Member Ron Wyden (D-OR), and other Democratic Members of the Senate Finance Committee today sent a letter urging Senate Finance Committee Chairman Orrin Hatch (R-UT) to allow Committee members to review President Trump’s tax returns, in light of the ongoing investigation into ties between Russia and Trump associates. U.S. Senators Ben Cardin (D-MD), Tom Carper (D-DE), Bob Casey (D-PA), Maria Cantwell (D-WA), and Michael Bennet (D-CO) also signed the letter.

“As you are aware, there have been numerous reports in the media of the Trump Administration, the Trump campaign, and other Trump associates’ close ties to the Russian government,” the Senators said. “Given the critical issues raised by the President’s business entanglements, we respectfully request that you use this authority to obtain the tax returns of the President and his business for review by committee members in a closed executive session of the Finance Committee. If Committee members identify ties or relations to foreign governments within these documents, we will respectfully request the Chairman and members of the committee hold a vote to make that information available to the public.”

The full text of the letter is available below.

Dear Chairman Hatch:

We write to urge you to use your authority as Chairman of the Senate Committee on Finance to request the tax returns of the President and his businesses for review by Committee members in closed executive session.

As you are aware, there have been numerous reports in the media of the Trump Administration, the Trump campaign, and other Trump associates’ close ties to the Russian government. These concerns are compounded by reports of the President’s business entanglements, which may reach around the globe, from Russia, to China, Azerbaijan, Saudi Arabia, the United Arab Emirates, Turkey, Qatar, Indonesia, the Philippines, and many others. Since becoming President, Mr. Trump has obtained a trademark registration for his Donald J. Trump brand from China shortly after providing U.S. policy concessions to the Chinese government, which could raise significant Constitutional concerns. These unprecedented conflicts of interest pose a threat to American national security and the integrity of the government of the United States.

The Senate Committee on Finance is charged with oversight of global financial crimes enforcement and international trade relationships, as well as the administration of our nation’s tax laws. As such, tax code section 6103(f)(4) grants the Chairman of the Finance Committee power to obtain tax return information from the Department of the Treasury. We regard the confidentiality of tax return information as a fundamental part of our tax system. Accordingly, the powers under 6103(f)(4) provide a venue for members of the Senate Finance Committee to examine matters of national importance in closed executive session, while maintaining the confidentiality crucial to our tax system. In 2015, Republican chairmen of the Congressional tax writing committees utilized this power to obtain more than 70 million individual items of taxpayer data.

Given the critical issues raised by the President’s business entanglements, we respectfully request that you use this authority to obtain the tax returns of the President and his businesses for review by committee members in a closed executive session of the Finance Committee. If Committee members identify ties or relations to foreign governments within these documents, we will respectfully request the Chairman and members of the committee hold a vote to make that information available to the public.

Next Article Previous Article