Senator Stabenow, Representative Kildee Join With Families to Announce Tax Cuts for Working Families, Payments Begin July 15th

The American Rescue Plan Expanded Child Tax Credit is Projected to Cut Child Poverty in Half

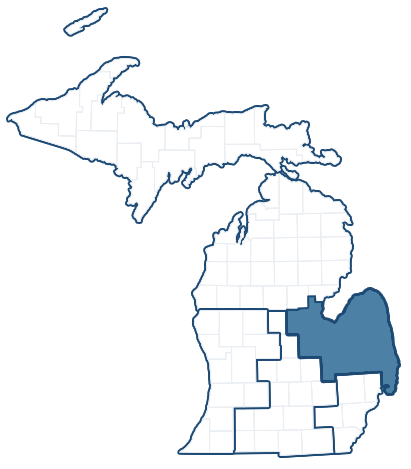

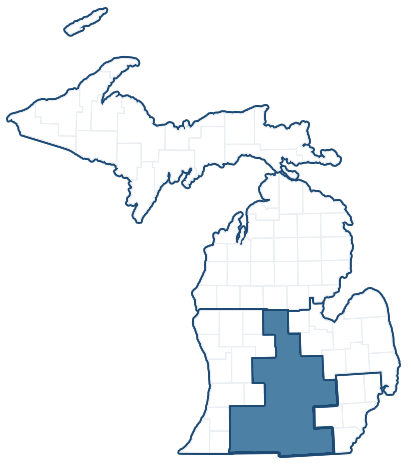

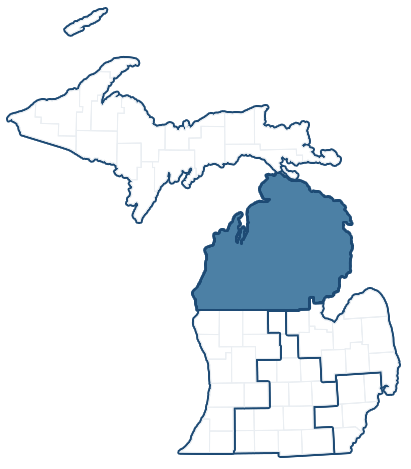

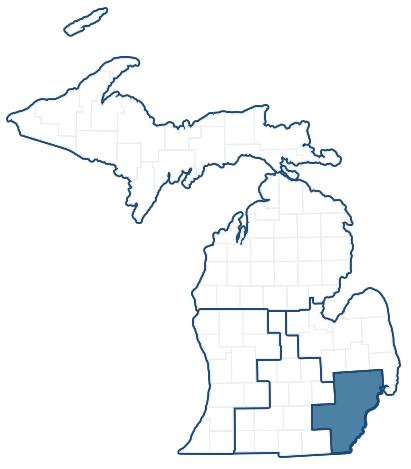

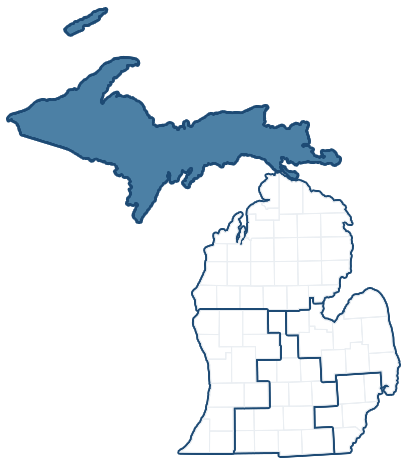

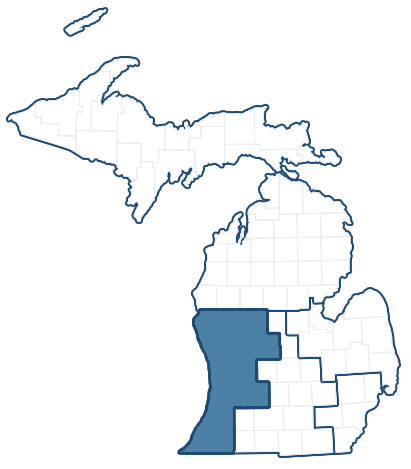

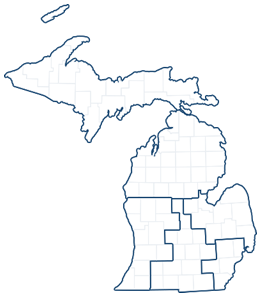

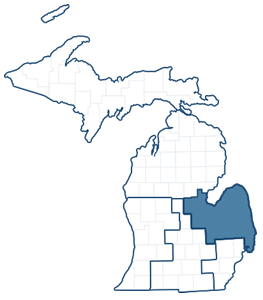

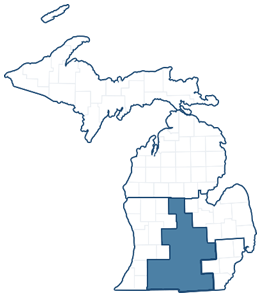

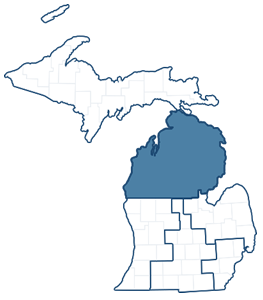

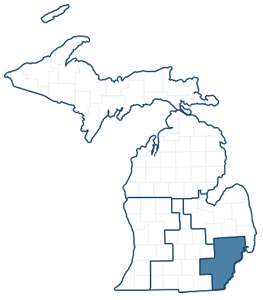

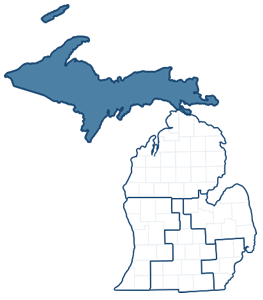

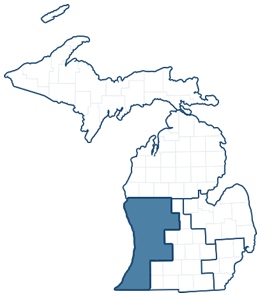

Tuesday, July 06, 2021U.S. Senator Debbie Stabenow (D-MI) and Representative Dan Kildee (MI-05) joined with child advocates to highlight tax cuts for working families included in the American Rescue Plan. Senator Stabenow and Representative Kildee were leaders in the effort to include a historic expansion of the Child Tax Credit in the American Rescue Plan. Combined with other parts of the Rescue Plan, it is projected to cut child poverty in the United States by half. They were joined by Ja’Nel Jamerson, the Executive Director of Educare Flint.

Michigan families will begin to receive monthly Child Tax Credit payments on July 15th. Monthly payments will be up to $250 for each child 6 to 17 years old and $300 for each child under age 6. In total, most Michigan families will receive $3,000 for each child ages 6 to 17 years old and $3,600 for each child under age 6. Most families will begin receiving monthly Child Tax Credit payments without any further action required. If families have not filed taxes for 2019 or 2020 or did not previously claim Economic Impact Payments, they must sign up to receive monthly Child Tax Credit payments through a new online IRS tool at www.childtaxcredit.gov.

“This pandemic has been tough for everyone. But families with children have been especially hard hit. This tax cut helps those who need it most to have additional resources to care for their children. It will improve the lives of millions of Michigan children, help moms and dads pay for child care and other essentials and allow them to successfully return to work. This is a very important part of the American Rescue Plan,” said Senator Stabenow.

“Thanks to the American Rescue Plan, help is on the way for Michigan families with children through the expansion of the Child Tax Credit. No Michigander should not have to struggle with paying bills or putting food on the table for your kids,” said Congressman Dan Kildee. “Starting July 15th, families will begin receiving monthly Child Tax Credit payments that will provide much-needed economic relief and help cut child poverty in half.”

“The newly expanded child tax credits acknowledge the critical tie between parents’ well-being and their children’s development, growth and preparation for success,” said Educare Flint Executive Director Ja’Nel Jamerson. “By providing parents with these tax credits, we improve access to many basic necessities and resources we know can break the generational cycles of poverty and disadvantage.”

In Michigan, it is estimated that the Child Tax Credit expansion will benefit more than 1.9 million children under age 18. For more information or to sign up for benefits, visit www.childtaxcredit.gov.

###

Next Article Previous Article