Senate Republicans Block Legislation to Bring Jobs Back to America, End Tax Giveaway to Corporations Shipping Jobs Overseas

Wednesday, July 30, 2014Senate Republicans today blocked a final vote on the Bring Jobs Home Act, legislation co-authored by U.S. Senator Debbie Stabenow to stop rewarding companies that move jobs overseas and instead create new incentives to bring jobs home. Her legislation would end a tax loophole that currently pays for companies to move jobs overseas, while maintaining the deduction for those bringing jobs home. In addition, it would also provide a 20 percent tax credit to help companies with the cost of bringing jobs back to America. Last week, an overwhelming bipartisan majority of 93 senators voted to move forward on the Bring Jobs Home Act. But today, for the second time since 2012, Senate Republicans filibustered this commonsense legislation.

"We need action, not excuses. Today, Senators had a choice between fighting for American workers and communities or fighting to protect a tax giveaway to companies that ship jobs overseas, and Senate Republicans voted against American jobs," Stabenow said. "It's outrageous that, right now, American workers are paying through the tax code to ship their own jobs overseas. We need to close this indefensible loophole and instead start rewarding the companies that are doing the right thing and bringing jobs back to America. In order to have a strong, growing economy that lasts, we need to make things here in America. It's time for my Republican colleagues to start focusing on exporting our products, not our jobs."

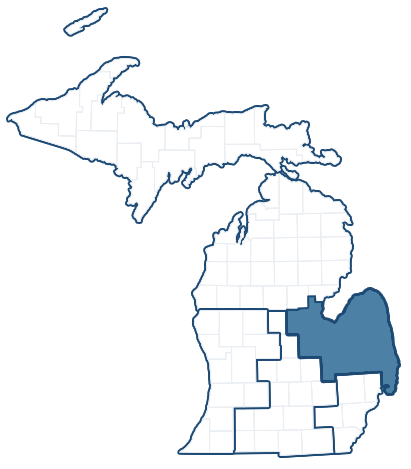

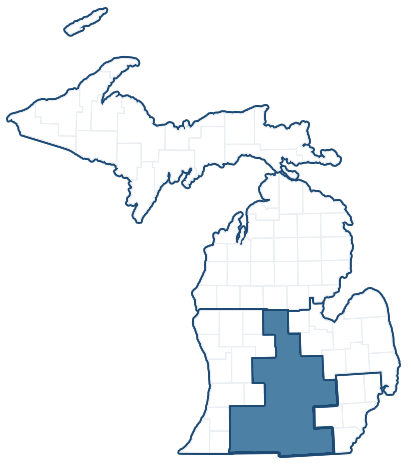

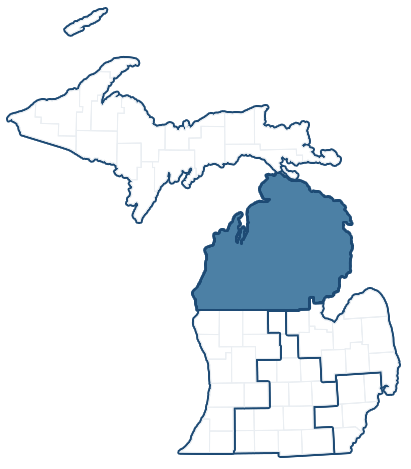

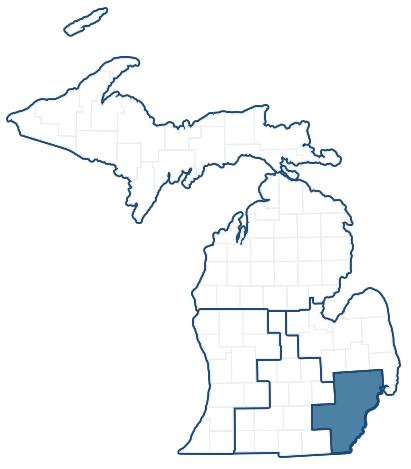

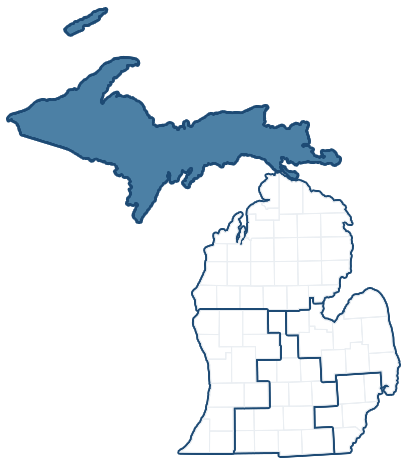

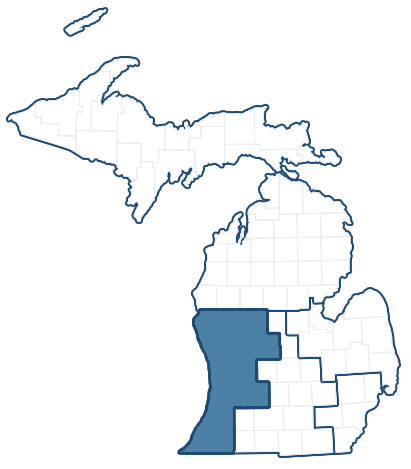

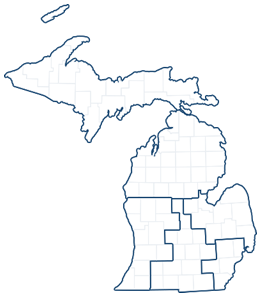

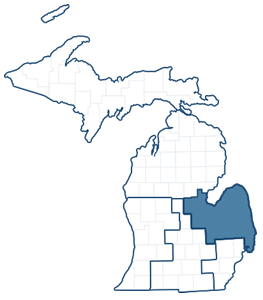

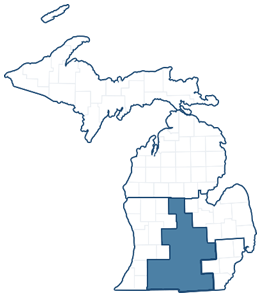

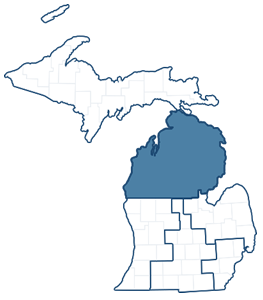

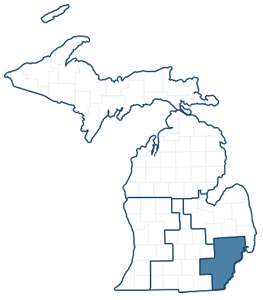

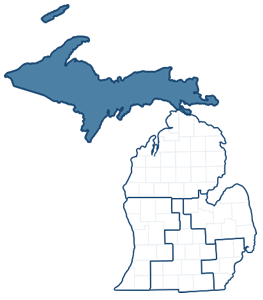

Over the past decade, 2.4 million American jobs have been shipped overseas, and approximately 21.5 million more jobs are at risk being moved overseas today. Michigan alone could lose an additional 737,000 jobs to offshoring. The Bring Jobs Home Act would strengthen manufacturing and other industrial sectors by encouraging companies to support American workers and move jobs back to Michigan and states across the country.

Senator Stabenow's Bring Jobs Home Act:

Ends a tax loophole that pays the moving expenses of companies that send jobs overseas. Right now, the cost of moving personnel and components of a company to a new location is defined as a business expense that qualifies for a tax deduction. Senator Stabenow's legislation would keep this deduction in place for companies that bring jobs and business activity back home but businesses would no longer be able to get a tax benefit for shipping jobs overseas.

Creates a new tax cut to provide an incentive for companies to bring jobs back to America. Specifically, her initiative would allow companies to qualify for a tax credit equal to 20% of the cost associated with bringing jobs back to the United States.

Next Article